A decade after its launch in 2016, the Startup India Mission is marking a milestone characterized by a robust IPO market and a strategic pivot towards deep-tech. The country’s startup ecosystem has evolved significantly, with Prime Minister Narendra Modi describing the last ten years as a “revolution.” This transformation is underscored by a record year for initial public offerings in 2025, where IPO volumes grew 13 percent year-on-year to Rs 1,89,020 crore, according to a report from Kotak Investment Banking.

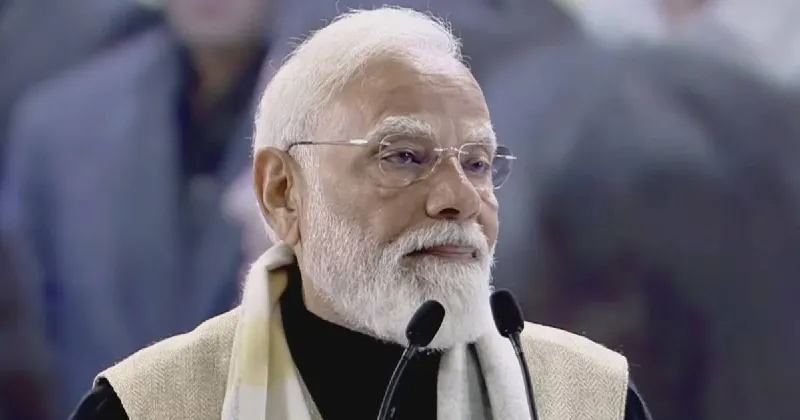

During an event at Bharat Mandapam, the prime minister celebrated the ecosystem’s expansion. He noted that India now has more than 200,000 startups, a dramatic increase from fewer than 500 a decade ago. The number of active unicorns has also grown from just four in 2014 to over 125 today. This growth has been supported by government measures aimed at easing compliance, establishing incubation centers, and opening sectors like space to private players. A research, development, and innovation fund worth Rs 1 lakh crore was also highlighted as part of this support structure.

A Strategic Push into AI and Deep-Tech

Beyond celebrating past achievements, government officials outlined a forward-looking agenda centered on strategic technologies. Prime Minister Modi urged the startup community to take the lead in artificial intelligence, framing it as a critical component of national security and competitive advantage.

“We now need to prepare ourselves for the future and work on new ideas. There are several domains emerging, such as AI, that will play an important role in strategic security and autonomy. A nation’s competitive advantage in the future will depend on how far it advances in AI innovation, and in India, startups must lead this effort.” — Narendra Modi

This sentiment was echoed by Ashwini Vaishnaw, Union Minister for Electronics and Information Technology, who stated that 80 percent of homegrown startups are now AI-led. He pointed to specific programs supporting this trend, such as the Design-Linked Incentive (DLI) scheme, which has extended support to 23 startups. Vaishnaw also mentioned the $1 billion India Deep Tech Alliance (IDTA), announced at Semicon India 2025, as a key source of institutional funding for the sector.

IPO Surge Signals Market Maturity

The increasing number of startups going public is seen by investors as a primary indicator of the ecosystem’s maturity. In 2025, 18 startups, including Lenskart, Groww, Meesho, and PhysicsWallah, listed on the stock market, raising over Rs 41,000 crore. This figure is a substantial increase from the Rs 29,000 crore raised by startups from the primary market in 2024.

Venture capitalists and investors agree that this trend reflects a fundamental shift. Archana Jahagirdar, founder and managing partner at Rukam Capital, observed that the emphasis has moved decisively towards sustainable business models. She added that the IPO market has been on a “structurally sounder trajectory” since 2021-22, with strong participation across both mainboard and SME listings.

The availability of a viable exit route through IPOs is also encouraging further investment. Angel investor Lloyd Mathias noted that public listings provide a welcome way for early investors to cash out, a process that was far more difficult before 2016. Bhaskar Majumdar, managing partner at Unicorn India Ventures, said that the government’s push and regulatory changes have created an environment conducive to exits. “Now, a large number of startups are doing IPOs and enabling liquidity to their early investors, and that is further spiralling the ecosystem,” he explained.

The government also shared data on inclusivity and funding, noting that 48 percent of recognized startups have at least one woman director. To date, more than Rs 25,000 crore has been disbursed under the first edition of the Fund of Funds for Startups scheme.